Will Bitcoin Surpass Its Previous Price High? – Market Info

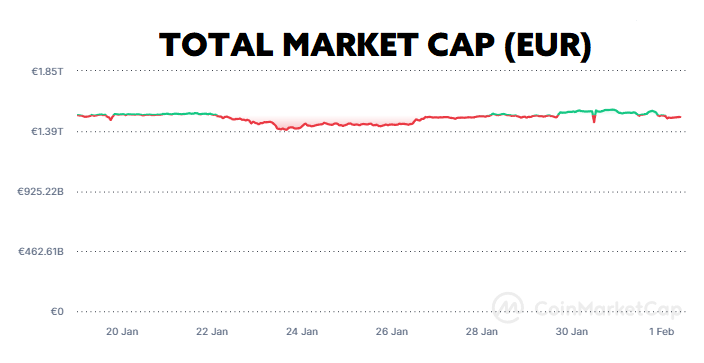

Over the past two weeks, the total market capitalisation exceeded €1.49 trillion. The decrease in market capitalisation over a 14-day period is 3.87%. The price of Bitcoin has fallen by 0.63 % over the last 14 days to a current value of over €39,000. Bitcoin’s dominance is currently around 52.6 %.

Source: Coinmarketcap

Will Bitcoin Surpass Its Previous Price High?

With the approval of a spot Bitcoin ETF in the United States and the coming halving, more and more experts are making no secret of their optimism that Bitcoin could reach a new price high as early as this calendar year. One of them is Anthony Scaramucci, founder of Skybridge Capital, who predicts significant bitcoin appreciation in the coming years.

He estimates that bitcoin could be worth as much as $170,000 in 18 months after halving (which will be in April), mainly due to the fact that there will be a significant reduction in the issuance of new bitcoins into circulation, creating a supply shock. His prediction, he says, is also based on historical trends, with bitcoin tending to quadruple in value in the 18-month timeframe after halving.

In the long term, Scaramucci thinks bitcoin will reach up to half the market capitalisation of gold, which would mean that the price of bitcoin would rise to over $300 thousand. Furthermore, Scaramucci expressed his appreciation to BlackRock CEO Larry Fink for changing his once negative attitude towards Bitcoin as digital gold.

A similar view has been taken in recent days by analysts at leading international bank Standard Chartered, who believe that Bitcoin is poised to surpass the $100 thousand mark, and in an optimistic scenario, they say it is even possible for Bitcoin to reach a value of up to $200 thousand in 2025.

Co-founder of the Coinflip crypto ATM network, Ben Weiss, thinks that it is the approval of the spot ETF and the upcoming halving that could make 2024 a record year for cryptocurrencies. “I wouldn’t be surprised to see bitcoin break six figures,” Weiss said.

Of course, it should be added that these are only predictions and may not reflect actual future developments. The situation surrounding Bitcoin’s growth will depend on several other factors, such as monetary policy or the geopolitical situation. Source

Grayscale Has Significantly Impacted Market Dynamics

Bitcoin’s plunge from nearly $49,000 to $38,600 within days of the launch of the first spot BTC ETF in the U.S. has shaken the entire crypto market significantly. Grayscale is reportedly a big contributor to the market correction and asset price decline, with a significant sell-off in GBTC shares following the conversion of its Trust into a spot ETF, driven in part by the bankrupt FTX crypto exchange.

Head of derivatives trading at Bitfinex Jag Kooner said that the conversion of Grayscale’s Trust into a spot Bitcoin ETF facilitated the sale of shares held by the bankrupt cryptocurrency exchange FTX. FTX reportedly sold off as many as 22 million GBTC shares worth nearly $1 billion in a matter of days, completely liquidating its position in GBTC.

Another factor that has greatly influenced the market correction following the launch of the ETF is the impact of fees at individual spot ETF providers. Kooner noted that Grayscale’s competitors currently charge fees ranging from 0.2% to 0.9%, while Grayscale has chosen to set its fees as high as 1.5%. The significant difference in fees has motivated many investors to move their funds out of GBTC and into cheaper bitcoin ETFs. Additionally, a number of companies waived fees for the first year, further encouraging migration from GBTC to other products.

As of Jan. 10, when several spot ETFs were officially approved, there were a total of 619,162 BTC in Grayscale’s fund. That number dropped to 492,112 BTC within three weeks, meaning Grayscale disposed of more than 127,000 BTC.

On the other hand, all other funds are seeing a regular inflow of new capital. BlackRock’s fund held a total of 63,488 BTC worth more than $2.5 billion as of January 30. Just behind the BlackRock fund is the Fidelity fund, which holds 53,802 BTC worth more than two billion dollars as of 30 January.

Despite Grayscale’s massive sell-off of BTC, the funds managed to attract more capital than actually flowed out of Grayscale. According to data from Lookonchain, the total BTC inflows minus outflows from Grayscale was 34,024 BTC. Source

Hong Kong Prepares for Spot ETFs

With the primary focus in the crypto community in recent months centring around spot bitcoin ETFs, Hong Kong players don’t want to be left out of the game and are gearing up to launch spot ETFs.

According to the latest information, the Hong Kong branch of Harvest Fund Management, which is a major asset manager in China, submitted an application to launch a spot bitcoin ETF to the financial regulator in Hong Kong last Friday. It is the first ever institution in Hong Kong to file an application for a bitcoin spot ETF.

The first application from institutions comes just over a month after Hong Kong’s financial regulators, the SFC and the Hong Kong Monetary Authority (HKMA), demonstrated their willingness to allow financial institutions to apply for spot ETF products. However, the regulators have outlined strict requirements for applicants, including strict custody rules and the manner in which ETF-related transactions must be executed – through SFC-licensed crypto platforms or authorised financial institutions that meet the HKMA’s regulatory requirements.

At the same time, regulators in Hong Kong have demonstrated a willingness to expedite the process of approving ETF applications. According to the information, if the companies are sufficiently prepared and meet all the necessary conditions, the first spot BTC ETFs could be listed on the Hong Kong exchange shortly after the Chinese New Year, which falls on February 10. Source

Google Has Launched Spot ETF Ads

Several companies, including BlackRock, VanEck and Franklin Templeton, immediately jumped at the opportunity and launched Google Ads campaigns for their spot bitcoin exchange-traded funds (ETFs). Just a few weeks ago, Google published an update to its terms and conditions, which included allowing ads on spot ETFs.

The ad campaigns are governed by Google’s policy update, which is effective January 30 and allows for the advertising of products labelled as “Crypto Coin Trust” in the U.S. While Google’s announcement about the permissible scope of the products was not entirely specific, it described them in general terms as financial instruments that allow shares to be traded in funds that hold crypto assets. Spot ETFs, of course, also fall into this category.

As the world’s leading search engine, Google’s change to its policies and terms and conditions opens the door for ETF providers to publicise their investment vehicles to a larger and more diverse user base. This strategic marketing could potentially accelerate the mainstream adoption of bitcoin ETFs, which are seen as a bridge between traditional finance and cryptocurrencies. Source

Visa to Allow Cryptocurrency Withdrawals on Debit Cards

Payments giant Visa has been relentless in its efforts to harness the potential of cryptocurrencies and blockchain technology. The latest evidence of the hard work and effort is teaming up with an infrastructure Web3 provider called Transak to introduce withdrawals directly to debit cards.

According to information available from the Cointelegraph website, the new integration will allow users to withdraw cryptocurrencies such as Bitcoin or Ethereum directly from a crypto wallet (such as Metamask) to a Visa debit card. This functionality is reportedly available immediately, allowing cryptocurrencies to be exchanged for fiat and paid for instantly at more than 130 million merchant locations worldwide that accept Visa cards.

The partnership also allows users from 145 countries to directly convert more than 40 cryptocurrencies to fiat without having to rely on interacting with centralised exchanges. The collaboration brings significant benefits to users of decentralised platforms and wallets such as Metamask and Ledger, as their users can now effortlessly transfer funds from their wallet to a Visa card, increasing the usability and practicality of their digital assets.

The collaboration also significantly expands the number of options for converting cryptocurrencies to fiat currencies and marks a major milestone in the interconnection between crypto and the traditional financial world, noted Harshit Gangwar, head of marketing at Transak. Source

SEC Delays Ethereum ETF Applications

The U.S. Securities and Exchange Commission (SEC) has extended its ruling period regarding the launch of BlackRock’s iShares Ethereum Trust spot ETF.

The SEC has extended the original 45-day review period for the application, with the SEC having until 25 January to comment on whether to approve or defer the application. The SEC decided to postpone the application because it reportedly needs more time to thoroughly consider the proposal and related issues surrounding the spot Ethereum ETF. Thus, the US regulator now has time to further review the application for a spot Ethereum ETF, with March 10 set as the earliest date by which the SEC must comment on the application.

Investors and industry experts are closely watching the SEC’s actions, as the approval of an Ethereum ETF would mark a significant milestone in the mainstream acceptance of cryptocurrencies. The extended review period indicates that the SEC is undertaking a thorough review of the application to ensure that any potential risks associated with the iShares Ethereum Trust are as minimal as possible. Source

INVEST WITH FUMBI

3 min •

3 min •