SEC Talks to ETF Applicants – Market Info

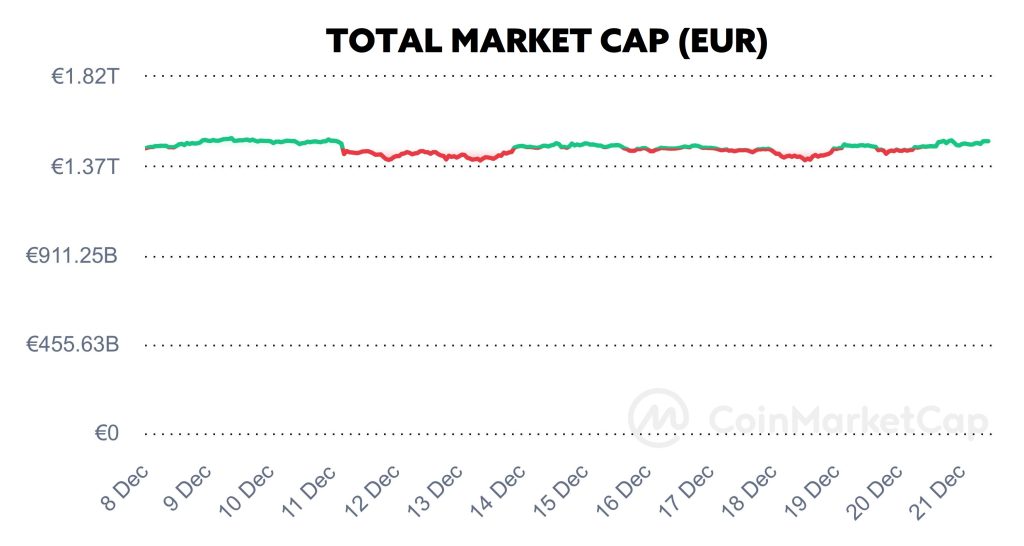

Over the past two weeks, the total market capitalisation exceeded €1.49 trillion. The increase in market capitalisation over a 14-day period is 1.46%. The price of Bitcoin has fallen by 0.37% over the last 14 days to a current value of over €39,950. Bitcoin’s dominance is currently around 53.6%.

Source: Coinmarketcap

SEC Talks to ETF Applicants

Over the past two weeks, the U.S. Securities and Exchange Commission (SEC) has kicked off a new round of discussions with companies that have filed to create a spot Bitcoin ETF in the United States. Representatives from Gary Gensler’s office met with company representatives to discuss details regarding the potential approval of a spot ETF.

Following the court filings, the regulator hosted representatives from BlackRock on Dec. 14 to discuss a proposed rule change that would allow the crypto investment vehicle to trade on major exchanges. According to Bloomberg ETF analyst James Seyffart, this was the third meeting between BlackRock and the SEC directly related to the creation of a spot ETF.

A few days earlier, namely on Dec. 8, the SEC met with representatives from Grayscale and Franklin Templeton, which are also among the applicants for the spot ETF. According to the information available, the companies’ representatives were to discuss the current status of their applications and the application of any changes required by the SEC.

In late November, SEC representatives also met with Hashdex’s team to jointly discuss potential market manipulation and investor protection risks. The discussion was also expected to cover the use of cash deposits and redemptions (the so-called cash creations and redemptions model), as well as spot purchases of bitcoins from physical exchanges within the Chicago Mercantile Exchange market.

As we have reported several times already, a number of large asset management firms are planning to launch spot bitcoin ETFs, including firms such as BlackRock, Fidelity, WisdomTree, Invesco and Grayscale. The U.S. regulator has yet to make a decision in this area in January, as it has already exhausted all options in terms of delaying its decision.

If the Bitcoin spot ETF is approved, the largest cryptocurrency on the market will be traded on major exchanges on Wall Street, opening Bitcoin to a wider audience of investors backed by the world’s most influential investment firms. If the SEC rejects the spot ETF, it is highly likely that investment managers will appeal the ruling, which could make the wait for a spot ETF significantly longer. Source

Google Changes Its Policy on Crypto Ads

Google itself believes in the approval of the spot ETF. Last week, the tech giant updated its cryptocurrency-related advertising rules to allow a specific type of crypto ads.

A report on Google’s rule changes and updates shows that the new rules for cryptocurrency ads and related products will allow advertisers to create ads for so-called “Cryptocurrency Coin Trusts” in the United States starting Jan. 29, 2024. Trusts, in this case, are seen as financial products that allow investors to trade shares in funds that hold large stocks of digital currency – including ETFs of funds.

Potential advertisers of these crypto ads must have Google certification in order to publish their ads. The certification requires advertisers to have the appropriate license from the corresponding local authority, and its products must meet all local legal requirements of the country or region for which they wish to obtain certification.

The policy change regarding ads on Google comes just as Bloomberg ETF analysts are assigning as much as a 90% chance of spot BTC ETF approval in the U.S. by Jan. 10, 2024, with the potential for multiple applications to be approved at once. Source

Accounting Changes for Cryptocurrencies in the U.S.

The Financial Accounting Standards Board (FASB) last week announced new rules that will require companies to account for cryptocurrencies at their fair value. The new rules are set to go into effect on December 15, 2024, but companies will be able to apply them earlier.

Under the new guidelines, which are the first of their kind in the United States, companies will have to disclose the value of cryptocurrencies based on their market price at the end of each reporting period. The move is intended to provide greater transparency and accuracy in financial reporting while acknowledging the volatile and volatile nature of digital assets, which includes Bitcoin or Ethereum.

Until now, accounting has treated Bitcoin as an intangible asset, meaning that if the price of Bitcoin fell below what companies bought it for, they had to recognise an impairment in the accounts, even if they had not sold it. However, if its price went up, the companies could not make an increase in value on the books until they sold the Bitcoin. This meant that Bitcoin was always accounted for at its lowest value.

The new accounting standards that will bring fair value accounting will allow companies to recognize unrealized gains or losses on a regular basis (for example, quarterly). Companies will thus be able to take advantage of and recognise a gain on an investment in Bitcoin in their accounts if it has increased in value without having to sell it. The new standards increase the likelihood that companies will purchase Bitcoin, add it to their balance sheet, and become long-term holders of Bitcoin because they will be able to recognize appreciation without having to sell anything.

At the same time, investors and regulators alike will have access to more timely and transparent information about the financial health of companies that own Bitcoin. Increased transparency is expected to spur greater confidence in an industry that is often plagued by fears of inadequate oversight and regulation. The introduction of fair value accounting rules for Bitcoin and other cryptocurrencies is certainly a significant step forward for the industry. Source

Ethereum Has Approved the ERC-3643 Tokenization Standard

The community behind the Ethereum blockchain has endorsed the new ERC-3643 tokenization standard. This standard is the first-ever standard designed specifically for compliant tokenization. The new standard improves on the widely used ERC-20 standard, particularly in the area of securities tokenization. It also enhances ERC-20 tokens with new controlled advanced features.

Joachim Lebrum, chair of the ERC-3643 Association’s Technology Working Group, said that “the ERC3643 standard is a groundbreaking step towards integrating advanced blockchain solutions into the enterprise sector, and this validation sends echoes across the ecosystem that ERC3643 is the superior standard for such use cases.”

ERC-3643 is a token standard for tokenization of securities, real-world assets (RWAs), payment systems and loyalty programs. The standard uses the Self-Sovereign Identity (SSI) framework to dynamically verify the suitability of users’ tokens. This feature ensures compliance through anonymous but verifiable credentials.

The new ERC-3643 standard aims to change the way companies use blockchain technology. It provides them with a secure and compliant framework to tokenize various assets. Ethereum’s official recognition of this standard demonstrates its goals to address the diverse needs of real-world users. It also establishes a benchmark for institutions implementing this framework in tokenization projects.

According to various surveys, the momentum of tokenization will increase significantly in the coming years. For example, HSBC’s analyst team predicts that the market for tokenized assets will reach a value of several trillion dollars by 2030. According to them, governments as well as major investment funds are showing increasing interest in this area and it can be expected that during the tokenisation wave, bonds, stocks and other mainstream financial assets will transition to blockchain-based models. Source

Are Cryptocurrencies Commodities or Securities?

The debate about whether cryptocurrencies are commodities or securities has been going on for years among investors and regulators alike. Different regulators have different views on this, and there is virtually no consensus on this issue.

A few days ago, Rostin Behnam, Chairman of the US Commodity Futures Trading Commission (CFTC), commented on the subject, stating that many cryptocurrencies are considered commodities under current laws. He also expressed concern about the need for clear regulatory guidelines, which have become a significant obstacle for businesses operating in the U.S. crypto industry.

Behnam has previously stated that digital assets, including Ethereum and stablecoins, are commodities. The CFTC affirmed this classification in a lawsuit against FTX founder Sam Bankman-Fried in December 2021, where the commission said Bitcoin, Ether and stablecoin Tether (USDT) are commodities.

In contrast, Gary Gensler, chairman of the Securities and Exchange Commission (SEC), has consistently argued that all cryptocurrencies except Bitcoin are securities and should be regulated by the SEC. Gensler argues that the public invests in cryptocurrencies with the expectation of profit, which means they meet the definition of securities. The differing views of the two regulators have led Behnam to describe the situation as a “turf war” over who will regulate the crypto industry.

Despite the ongoing differences of opinion on cryptocurrencies, Behman maintains a positive working relationship with the SEC, emphasizing that the two agencies share the same interest in protecting U.S. markets, the country’s financial ecosystem and consumers. Source

Curiosity: Donald Trump Unveils Another NFT Collection

Former United States President Donald Trump has announced the launch of his third collection of non-interchangeable tokens (NFTs), called Mugshot, which revolves around the topic of his ongoing criminal charges.

Users interested in purchasing NFTs, regardless of their chosen payment method (credit card or wETH), will be required to provide identity verification known as Know Your Customer (KYC). The cost of each digital card in this collection is $99, and those who purchase 47 or more cards will have the opportunity to receive a piece of the former president’s actual suit from his famous mugshot, along with dinner at Mar-a-Lago with Trump himself.

Donald Trump has unveiled his third collection as he runs again for President of the United States in the 2024 election. Trump is currently facing a total of 91 criminal charges related to allegations of business fraud and attempts to overturn the 2020 U.S. presidential election. Source

START INVESTING

3 min •

3 min •