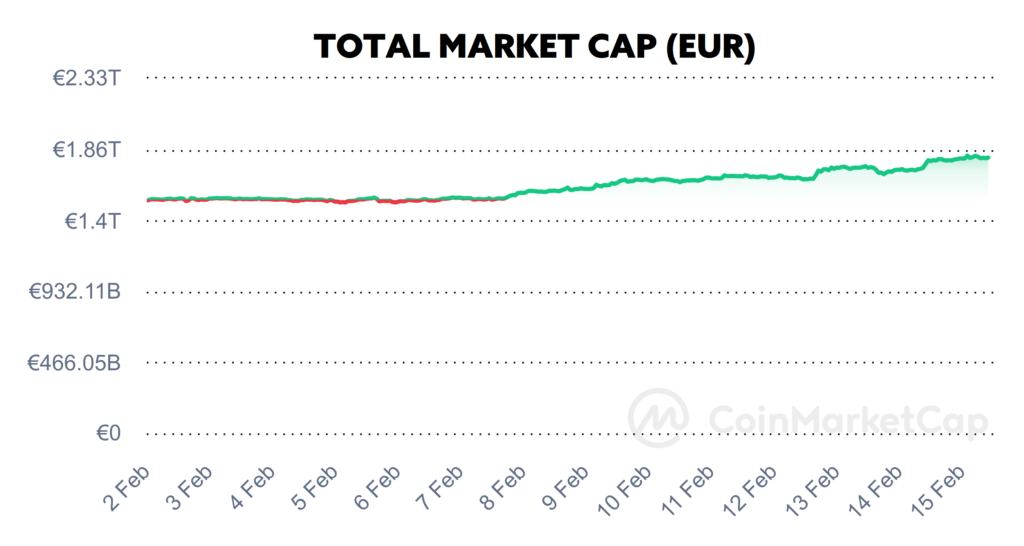

Bitcoin Is Back Above $50,000 – Market Info

Over the past two weeks, the total market capitalisation exceeded €1.81 trillion. The increase in market capitalisation over a 14-day period is 21.47%. The price of Bitcoin has risen by 24.6% over the last 14 days to a current value of over €48,600. Bitcoin’s dominance is currently around 54.1%.

Source: Coinmarketcap

Bitcoin Is Back Above $50,000

Bitcoin, the most famous and largest cryptocurrency, surpassed the psychologically important threshold of 50 thousand US dollars on Monday afternoon and has risen by more than 15% since the beginning of 2024. Bitcoin’s rise above this level comes at a time of increased interest in Bitcoin from institutional investors, the coming Bitcoin halving, as well as possible interest rate cuts in the United States

Data from the Coinmarketcap website shows that the last time Bitcoin reached the $50-thousand dollar mark was back in December 2021, just weeks after Bitcoin reached its highest price level to date at $69-thousand dollars.

However, in an interview with Cointelegraph, eToro analyst Josh Gilbert said that macroeconomic conditions are much more favorable for risk assets like bitcoin this time around than they were in December 2021. “We’ve got four or five cuts lined up from the Federal Reserve in 2024, the fourth bitcoin halving that will enhance the asset’s scarcity, and further inflows to bitcoin ETFs after already seeing billions of dollars flow in just weeks after launching.”

A report from CoinShares on Feb. 12 revealed that spot bitcoin ETFs attracted as much as $1.1 billion from investors last week, the strongest week in terms of inflows since the launch of spot ETFs.

As the data suggests, however, interest from retail investors is still relatively low. Analyst Will Clemente said on Social X that this behavior could indicate a more sustainable basis for growth in the broader market. Search interest for the term “bitcoin” hovered around 39 points in December 2021, according to Google Trends data, with the search term currently only reaching 19 points. Source

Franklin Templeton Has Filed for Spot Ethereum ETF

Franklin Templeton, which has its own spot bitcoin ETF currently running and has more than $1.5 trillion in total assets under management, has filed to launch a spot ETF for the cryptocurrency Ethereum, according to a Feb. 12 Form S-1 registration statement. This makes Franklin Templeton the next Wall Street giant, after BlackRock, interested in launching an Ethereum ETF.

In its application, the company chose Coinbase Custody Trust Company and Bank of New York Mellon as its fund managers. As ETF manager, Coinbase would reportedly be responsible for custody and management of the private keys to the wallets on which the underlying assets will be stored.

Like BlackRock and ARK Invest, Franklin Templeton also cited a cash-only model for creating and redeeming shares in its application. The proposed ETF is designed to be listed and traded on the CBOE BZX Exchange, offering investors a simple and quick way to gain exposure to the cryptocurrency Ethereum without having to worry about custody or purchase.

This filing by Franklin Templeton comes on the heels of a recent move by the U.S. Securities and Exchange Commission (SEC) to solicit public feedback on a proposed rule change to the listing and trading of Ethereum spot ETFs from Galaxy Digital and Invesco. Source

Spot ETFs Are Rocking the Markets

A really interesting and unusual thing happened in the cryptocurrency market this Monday. Spot bitcoin ETFs collectively bought up to 10 times more bitcoins on this day than came into circulation through mining for the entire day.

Mining is the process through which transactions and blocks are verified, for which miners are rewarded through what is known as block bounty. The reward per block mined is currently 6.25 BTC, with an average of roughly 6 blocks mined per hour. This means that an average of 900 new bitcoins are put into circulation per day.

However, according to data from individual spot ETFs, funds cumulatively bought as many as 10,280 bitcoins worth $493.4 million on Monday, with those purchases more than 10 times the issuance of new bitcoins entering circulation.

BlackRock’s iShares Bitcoin Trust saw the highest inflow on the day, with investors putting in as much as $374.7 million. Funds from Fidelity and Ark 21Shares also saw significant inflows, with $151.9 million and $40 million flowing in, respectively. On the other hand, Grayscale saw $95 million in capital outflows from its spot ETF on the day, and roughly $20 million left the Invesco Galaxy ETF.

A similar trend was observed on February 9, when a total of 12,700 BTC worth $541.5 million flowed into the ETF, while a total of 980 BTC worth roughly $45 million was withdrawn on that day.

Excluding the fund from Grayscale, which has been converted to a spot ETF, the largest ETF fund as of Tuesday was the fund from BlackRock, which already has 95,277 BTC worth $4.9 billion in its fund. The second largest fund is a fund from Fidelity, which holds approximately 76,430 BTC. Since the launch of spot ETFs, a total of 227,986 BTC has flowed into these funds, while Grayscale has divested approximately 153,773 BTC at the same time. However, this means that even after accounting for Grayscale’s divestments, the net inflow is still positive at 71,584 BTC.

According to the available data, as much as 80% of the total bitcoin supply has not moved from its addresses in the last 6 months, which means that only roughly $200 billion in BTC is realistically tradable. Bitcoin ETFs have thus sucked up to 5% of the total tradable bitcoin supply in the last 30 days. Source

Ethereum Awaits Next Update

The long-awaited upgrade on the Ethereum network, dubbed Dencun, is reportedly expected to be rolled out to the main Ethereum network as early as March 13 at around 14:55 CET. Following the successful implementation of the Dencun upgrade on the Holesky test network a few days ago, the Ethereum development team has agreed on a date for the rollout of this upgrade to the main network.

The reason why the crypto community is anticipating this update is because of the Ethereum 4844 (EIP-4844) network enhancement proposal, also referred to as “Proto-Danksharding”, which will be included through the Dencun upgrade. Simply put, this update will introduce so-called “blobs,” which are gaps in blocks that allow more information to be stored in a single block while maintaining the same block finality time.

“Those blobs are especially beneficial to Ethereum’s layer-2 blockchains, which will have more of their transactions stored in the network’s blocks. For users, this will result in layer-2 fees at least 10 times cheaper,” explains Rony Szuster, a crypto analyst at Brazilian exchange Mercado Bitcoin. Source

Bitcoin Reaches ATH in Argentina

Bitcoin reached a new all-time high in Argentina, shooting to a record high of 40 million pesos per BTC. Against the backdrop of a plummeting Argentine peso, which has seen a staggering 99% decline against the US dollar since 2018, digital assets are becoming a sort of lifeline of financial resilience and stability for many Argentines.

Argentina is one of the most economically unstable countries, with frequent currency devaluations that complicate reserve building as well as financial stability for its residents. Over the past century, it has oscillated between periods of growth and dysfunction, transforming itself from one of the richest countries in the world into a country with a protracted financial crisis, mounting debt and triple-digit inflation.

As a result, citizens have turned to digital assets, demonstrating their strong acceptance of crypto. In an effort to preserve purchasing power, Argentines have resorted to popular stablecoins such as USDT and USDC to avoid devaluing their money. According to findings from Chainalysis, Argentina ranks 15th globally in digital asset adoption.

According to the Organisation for Economic Co-operation and Development (OECD), inflation in the country is projected to reach a staggering 250.6% in 2024. Furthermore, the country’s economic downturn is expected to surpass earlier forecasts. However, a few weeks ago, the newly elected Argentine President, Javier Milei, initiated major reforms, such as the dollarisation of the country and changes to the national banking system. Source

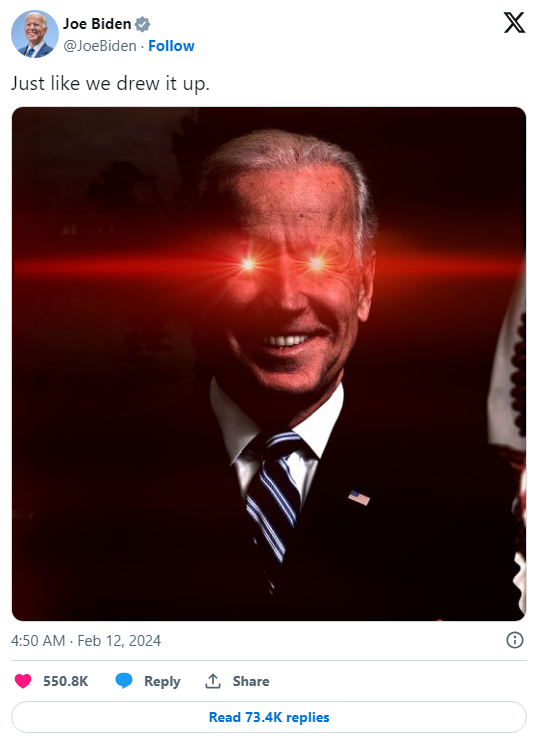

Interesting Fact: Joe Biden Posted a Photo With Legendary Laser Eyes

United States President Joe Biden inadvertently made a Bitcoin fan of himself after posting a photo of himself with laser eyes on his social media profiles X and Instagram.

Source: Twitter.com/JoeBiden

Laser eyes are often used in the crypto community and are used by Bitcoin’s most loyal and dedicated fans and supporters. This phenomenon took off on social media a couple of years ago and generally signals a bullish outlook on the cryptocurrency Bitcoin.

However, Joe Biden actually used laser eyes for the sake of reacting to the Kansas City Chiefs’ victory over San Francisco in Super Bowl 2024 and in reality it had nothing to do with promoting Bitcoin. Although as it seems, the laser eyes did help Bitcoin and Joe Biden indirectly promoted it. Source

TAKE ADVANTAGE OF CRYPTO’S POTENTIAL

3 min •

3 min •