Bitcoin Halving in a Few Months – Market Info

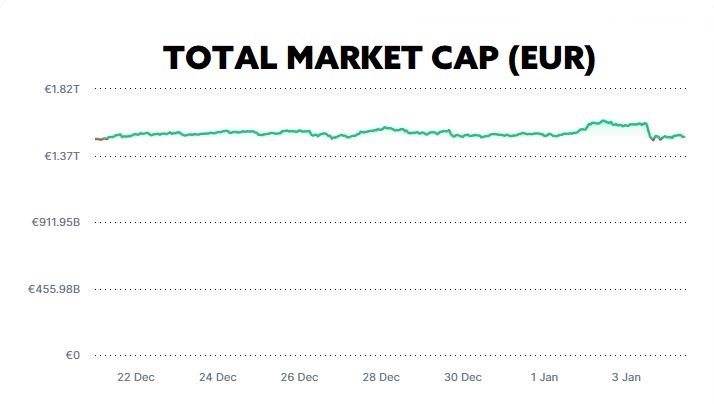

Over the past two weeks, the total market capitalisation exceeded €1.50 trillion. The increase in market capitalisation over a 14-day period is 0.67%. The price of Bitcoin has fallen by 1.83% over the last 14 days to a current value of over €39,220. Bitcoin’s dominance is currently around 52.6%.

Source: Coinmarketcap

Bitcoin Halving in a Few Months

Bitcoin and the cryptocurrency market as a whole have entered a new year that will undoubtedly be full of interesting events. One of the most important and anticipated events of this year is the Bitcoin halving, which will take place after almost four years.

It is 2024 that will be the year when the Bitcoin network will undergo another Bitcoin halving. This event, pre-defined in the Bitcoin source code, is a significant milestone for the entire cryptocurrency, reducing the rewards miners receive for verifying transactions and producing new blocks every 210,000 blocks mined. The upcoming halving, which is highly likely to take place as early as April, will cut the reward for mining a block by exactly half from the current 6.25 BTC per block to 3.125 BTC per block mined.

So far, in its entire history, the Bitcoin network has only undergone three halving events, each of which was followed by a significant increase in the price of Bitcoin. The main reason for these increases has been the decreasing supply of Bitcoins available, making Bitcoin a rarer and less available asset. The growth in value is also due to the spreading awareness and ever-increasing adoption of Bitcoin, which is the source of the growing demand for Bitcoin.

The reduction in royalties from mining is also a particularly significant event for miners, as halving directly impacts profitability and return on investment in hardware and operating costs. Commenting on the topic of the upcoming halving, Jaime Leverton, CEO of mining company Hut8, said that this event will force miners to increase the efficiency of their operations so that they can continue mining.

Taras Kulyk, founder and CEO of mining company SunnySide Digital, sees the importance of a direct correlation between the reduction in block rewards and the price and fees on the Bitcoin network. “If that’s not met by increased Bitcoin price or increased transaction fees, lower-efficiency miners will need to shut down,” said Kulyk, who also added that the existing network of miners will continue to secure the bitcoin blockchain as long as the economic incentives pay them for the risk they take. Source

Bitcoin Price Breaks Above $45K

As we enter a new calendar year, the price of Bitcoin has reached a 21-month high, surpassing the $45,000 mark last seen in April, just before the collapse of blockchain platform Terra.

Bitcoin began surging on the evening of January 1, rising from a price of $42,000 to $45,700 within 24 hours. Since the beginning of this year, Bitcoin has risen by more than 6%, with an appreciation of up to 165% over the last calendar year.

Bitcoin is currently trading higher than any price reached in 2023 and reached its 21-month high just two days after the start of the new year. Bitcoin’s price surge is highly likely related to preparations for the U.S. Securities and Exchange Commission (SEC) to approve several of a total of 14 open applications to create a bitcoin spot ETF in the coming days.

The last time bitcoin traded above $45,000 was back on April 5, 2022, when bitcoin closed its trading day at $45,241. Subsequently, bitcoin entered a persistent bear market, during which the bitcoin price fell to a low of $15,600 in late 2022. Source

ETF Applicants Submitted Their Updated Applications

Companies seeking regulatory approval to launch exchange-traded funds (ETFs) tied to the spot price of bitcoin submitted their updated applications to the Securities and Exchange Commission (SEC) in late December.

By late last Friday evening, BlackRock Asset Management, VanEck, Valkyrie Investments, Bitwise Investment Advisers, Invesco Ltd, Fidelity, WisdomTree Investments, and Ark Investments & 21Shares had submitted new documents detailing agreements related to the launch of the spot ETF. In the filings, the companies listed, for example, their market makers (so-called market makers) who would provide liquid and efficient trading.

Stakeholders familiar with the process of submitting updated applications told Reuters that issuers that met their application review deadlines late in the year could potentially see their applications approved as early as January 10. January 10 is the deadline by which the SEC must finally approve or disapprove the applications from ARK Investments & 21Shares. The whistleblowers also said that the SEC may issue a final opinion even earlier than January 10.

Currently, there are as many as 14 companies in the game seeking approval for bitcoin spot ETFs. Over the past few years, the SEC has rejected multiple attempts to bring these types of products to market, citing concerns about market manipulation and the inability of issuers to protect investors. So far, the SEC has only approved ETFs tied to futures contracts that are traded on the CME. Source

Argentina Allows Bitcoin-Denominated Private Agreements

Before the elections, the new Argentine President Javier Milei promised to implement a libertarian economic programme. Immediately after taking office, he issued more than 350 economic deregulations aimed at removing industry barriers, one of the new regulations being the acceptance of bitcoins and other cryptocurrencies as a legitimate means of payment for contractual transactions.

Chancellor Diana Mondino on social network X confirmed the regulation, which will allow contracts denominated in bitcoin or other cryptocurrencies to be entered into within the country. “We ratify and confirm that in Argentina, contracts can be agreed upon in Bitcoin. And also in any other cryptocurrency and kind, such as kilograms of beef or liters of milk. The debtor must deliver the corresponding amount of the designated currency, whether the currency has legal tender in the Republic or not,” Mondino said.

The move thus opens the door to private contracting denominated in a variety of emerging assets, including Bitcoin. President Milei and the country’s political leaders have introduced dramatic emergency measures to rebuild Argentina’s battered economy after years of high inflation and financial uncertainty. President Milei has expressed his favourable views on Bitcoin in various discussions in the past but has never directly proposed that Bitcoin be legal tender in the country. He has, however, stated that Bitcoin is a natural response to central bank fraud, which he believes is the source of financial crises. Source

Ethereum Founder Reveals His Vision for 2024

Vitalik Buterin, co-founder of Ethereum, the largest smart contract platform, released his vision and roadmap a few days ago, detailing his planned activities on the Ethereum network for 2024. In a series of tweets, Buterin stated that the 2024 roadmap includes several changes from the 2023 roadmap and that the network is set to focus on the development of the different phases in the Ethereum network.

As recently as September 2022, there was an update to The Merge that ensured the Ethereum network transitioned from a Proof-of-Work consensus mechanism to a Proof-of-Stake mechanism. Following the network’s transition to PoS, Ethereum developers plan to focus on implementing a task called single slot finality (SSF) in the near term to address the current shortcomings of the Ethereum network.

The SSF concept should ensure that Ethereum’s consensus mechanism verifies blocks more efficiently – blocks could be designed and finalised in the same slot, which could significantly reduce the time to finalise transactions, known as time-to-finality. Buterin believes this is the simplest way to solve the Proof-of-Stake problems in the Ethereum network.

Another plan to improve Ethereum, according to Buterin, is a development phase referred to as The Surge, which aims to bring Ethereum’s scalability up to 100,000 transactions per second through so-called rollups. The Ethereum co-founder revealed that cross-rollup standards are currently seen as areas for long-term improvements, and significant progress will be made in scaling rollups in 2024, both through enhancements to EIP-4844 and through improvements directly on the rollups themselves.

In addition, Vitalik also mentioned the Verge development phase in his vision, which should make block verification easier. This is to be achieved through so-called Verkle Trees, which would ensure that block verification would only involve downloading a few bytes of data and performing basic computations, which entails verifying the Succinct, Non-Interactive Argument of Knowledge, known in the crypto community by its acronym SNARK. Source

Curiosity: Jim Cramer Has Changed His Stance on Bitcoin

Longtime Bitcoin crypto-critic Jim Cramer made a surprising turn in his rhetoric a few days ago, referring to Bitcoin as a “technological miracle” that cannot be destroyed.

In a recent appearance on CNBC’s Squawk on the Street, Cramer admitted that Warren Buffett and the late Charlie Munger were blind to Bitcoin’s potential. “Charlie Munger, who was so brilliant on so many things, was blind to this,” Cramer said.

Cramer’s turnaround in his perception of Bitcoin comes just as Bitcoin surpassed the $45,000 mark on Jan. 1, its highest level since April 2022, a significant reversal from Cramer’s previous statements in which he was very pessimistic about cryptocurrencies. Cramer also warned that not all cryptocurrencies will survive and therefore one should be appropriately cautious when investing in cryptocurrencies. Source

START INVESTING

3 min •

3 min •